Istanbul Turkey Real Estate in 2025 Trends and Future Expectations

Istanbul Turkey Real Estate in 2025 Trends and Future Expectations

As we move through 2025, Istanbul's property sector is experiencing significant shifts driven by economic policies, infrastructure developments, and sustained foreign investment.

This article explores the current state of Istanbul’s real estate in 2025, analyzing price trends, demand drivers, key investment locations, and future projections. Whether you're a local buyer, an international investor, or a market analyst, understanding these trends will help you make informed decisions.

Current State of Istanbul’s Real Estate Market (2025 Statistics)

Price Trends and Market Performance

As of 2025, Istanbul’s real estate prices have shown resilience despite global economic fluctuations.

- Residential prices average $1,800 per sqm in prime districts like Beşiktaş, Kadıköy, and Şişli, while luxury waterfront properties exceed $4,000 per sqm.

- Commercial real estate in business hubs (Levent, Maslak) ranges between $3,000–$6,000 per sqm, reflecting strong corporate demand.

- Compared to 2024, prices have risen by 12–15%, outpacing inflation due to high demand and limited premium inventory.

Demand and Supply Dynamics

- Over 150,000 new units entered Istanbul’s market in 2025, yet demand continues to outstrip supply in central districts.

- Absorption rates are at 85–90% for mid-range projects, with luxury developments selling out within months of launch.

- The most sought-after properties include smart homes, sea-view apartments, and gated community villas.

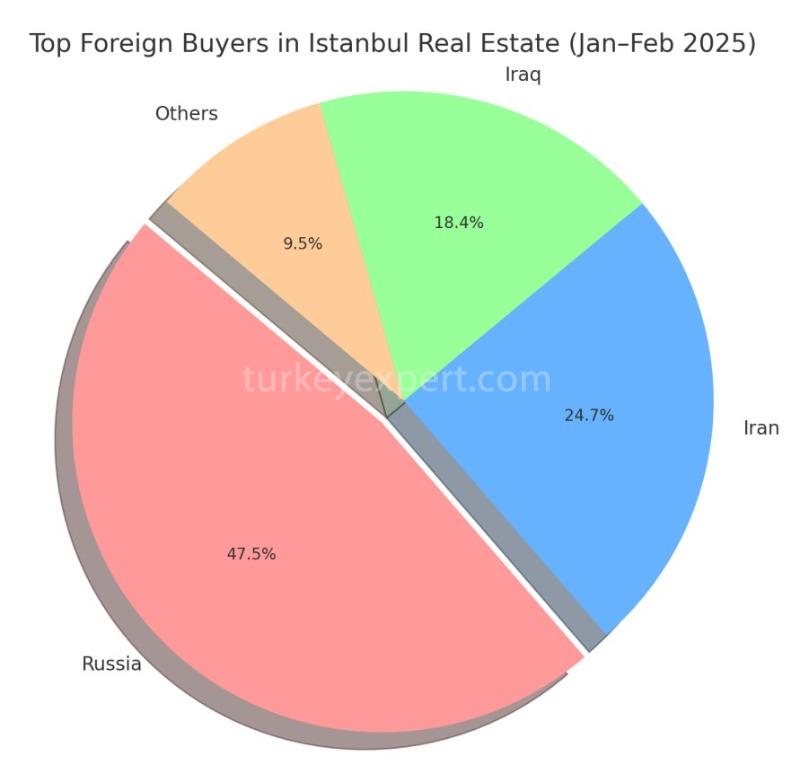

Foreign Investment Trends

- Foreign buyers accounted for $8.5 billion in real estate transactions in 2024, with 2025 expected to surpass $10 billion.

- Top investors: Russians (35%), Iranians (20%), Gulf nationals (15%), and Europeans (10%).

- Turkey’s citizenship-by-investment program remains popular, now requiring a $400,000 minimum (up from $250,000 in 2022).

Key Factors Driving Istanbul’s Real Estate Growth in 2025

Economic Stability and Inflation Control

- Turkey’s new fiscal policies have stabilized the lira, with inflation dropping to 35% (down from 65% in 2023).

- Mortgage rates have fallen to 1.8% monthly (down from 2.5% in 2024), boosting local buyer activity.

- Foreign investors still prefer USD/EUR-denominated deals to hedge against currency risks.

Infrastructure and Mega Projects

- Istanbul Canal: Though delayed, land prices near the proposed route (Arnavutköy, Başakşehir) have surged 40% since 2023.

- New Airport expansions: Istanbul Airport now handles 100M+ passengers annually, driving demand in nearby areas like Eyüp and Arnavutköy.

- Metro expansions: The new Pendik-Sabiha Gökçen and Halkalı-Ispartakule lines have boosted suburban growth.

Urban Transformation (Kentsel Dönüşüm)

- The government’s urban renewal program has accelerated, replacing 500,000+ at-risk buildings with earthquake-resistant structures.

- Neighborhoods like Esenler, Küçükçekmece, and Fatih are seeing 30–50% price increases due to redevelopment.

Tourism and Short-Term Rentals

- Istanbul expects 20M+ tourists in 2025, reviving demand for short-term rentals.

- Airbnb yields average 7–10% in Sultanahmet and Beyoğlu, outperforming long-term rentals.

Most Sought-After Locations in Istanbul (2025)

European Side Hotspots

- Beşiktaş & Ortaköy: Luxury apartments ($5,000–$10,000/sqm).

- Beylikdüzü & Esenyurt: High rental yields (6–8%) for budget investors.

- Başakşehir: Family-friendly projects near sports hubs.

Future Expectations (2026 and Beyond)

- Prices to rise 10–15% annually in prime areas.

- Potential risks: Oversupply in suburbs, geopolitical factors.

- Smart cities and green buildings gaining traction.

Final words

Istanbul’s real estate market in 2025 remains a high-growth, high-opportunity sector for local and foreign investors. With strong infrastructure projects, economic stabilization, and sustained demand, the city is poised for long-term appreciation. Investors should focus on central districts, urban renewal zones, and upcoming transport hubs for the best returns.

At Turkey Expert, we're always just a call or message away. Whether you're starting your property search or narrowing down your options, our team is here to help you find the ideal property in Turkey.

Updated on 2025-05-12

Turkish Citizenship

Turkish Citizenship English

English Русский

Русский Türkçe

Türkçe فارسی

فارسی عربي

عربي  Nederlands

Nederlands Deutsch

Deutsch Français

Français Español

Español 中国人

中国人